6410 South Dante Avenue, Chicago, IL 60637

Phone: 773-324-1020 Fax: 773-324-9235

Give

Gift Planning

“IRA Rollover” Gifts (QCD)

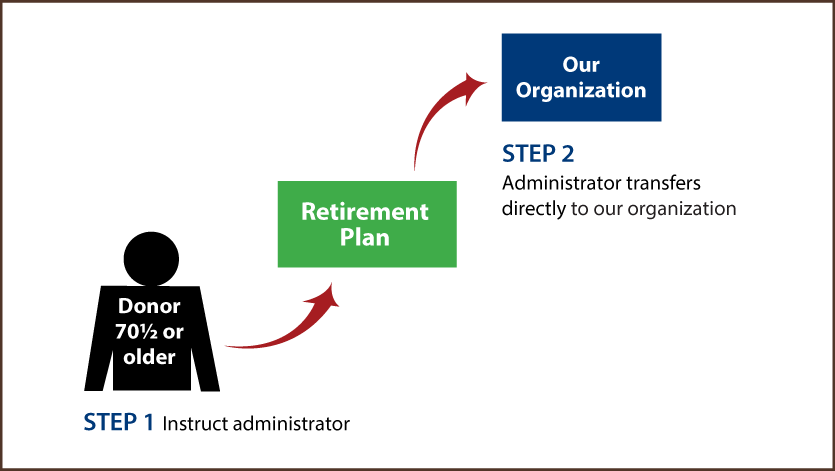

How It Works

- You are 70½ or older and instruct your plan administrator to make direct transfers to us and any other charities that, cumulatively, do not exceed $111,000 for 2026 in the case of outright gifts or $55,000 in 2026 in the case of transfers for a life-income plan.

- Plan administrator makes transfer as directed to the MC Educational Foundation

Benefits

- Your gift is transferred directly to the MC Educational Foundation; since you do not receive the funds, they are not included in your gross income*

- The amount you transfer will count towards your mandatory distribution if you have attained the age when required distributions begin. That age, which had been 72, was raised to 73 for those who become 72 between January 1, 2023, and December 1, 2032, and 75 for those who reach the age of 74 after December 31, 2032.

- You support the programs that are important to you at Mount Carmel

*No income-tax deduction is allowed for the transfer.

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Ryan Julian |

Mount Carmel High School |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer